Borrow money with

5paisa Loans

- Loan starting at 10% pa

- Disbursement within 24 hour

Why borrow?

Borrowing through a peer-to-peer lending platform is quick, hassle-free, collateral free and affordable.

Quick and hassle-free personal loan

It’s a 4-step application process, and requires minimal documents. The process is paperless with disbursement within 24 hours.

Secured and completely digitised process

Create passive monthly income with regular repayments from borrowers

Collateral free borrowing at affordable interest rates

Get unsecured loans up to 10 Lakhs with interest rates starting as low as 10%.

Save on charges

Lending on 5paisa loans offers an alternate investment to help you diversify your portfolio

Secured process

All your personal data is protected and confidential at all times.

Eligibility Criteria

Avail instant personal loan through our best-in-class lending platform. All you need to do is

enter few details and check your loan eligibility. Our criteria for eligibility is fairly simple.

-

Resident of

India -

At least 21

At least 21

years old -

Monthly income

of at least ₹ 18,000 -

Income proof

documents -

PAN card

-

Valid Id and Address proof

-

Valid Bank account

What are the documents required to register as borrower?

Borrowers are evaluated on various parameters and not just on the CIBIL score. Following documents are required to complete loan application.

- PAN Card

- Aadhaar Card

- 3 months salary slip / ITR

- 6 months bank statement

self employed

- PAN Card

- Aadhaar Card

- Last 2 years ITR

- 6 months bank statement

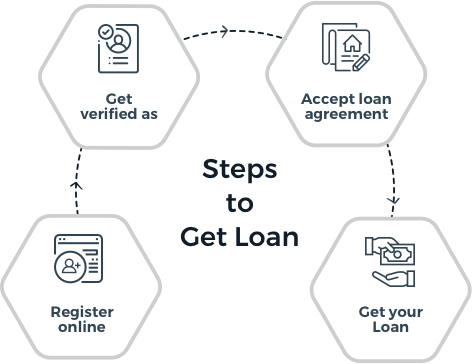

How to Get Loan?

You can get your loan amount in just 4 steps. Once the process is complete, your loan amount is disbursed in less than 24 hours.

Borrowing Process

Easy and hassle free online personal loan application process

-

1. Register and upload documents

Create a borrower's account by filling in a simple online form and uploading copies of requisite documents.

-

2. Evaluation of loan application

Your details along with the documents are verified by our in-house team. Our evaluation parameters include credit score, open loans and income in hand amongst others.

-

3. Listing as active borrower

Post successful credit evaluation, borrowers are listed on our platform along with their creditworthiness details in terms of approved loan amount, applicable EMI and interest rate.

-

4. Accept loan agreement

Borrowers can accept the loan online by signing a legally-binding agreement between the borrower and the lenders. You can choose the EMI date as per your convenience.

-

5. Loan disbursed

We take less than 24hrs to process your loan application, and once approved, the loan amount is deposited in your bank account the same day.

Rates and Charges

Personal loans at competitive interest rates with pocket-friendly EMIs

5paisa P2P Limited offers easy loans at the interest rate appropriate to the creditworthiness of the borrowers. The interest rate starts from 10% on our platform.

-

Registration fee

The borrower has to pay a fixed registration fee of Rs 300 to apply for personal loan. Registrations fee is a one-time fee paid by the user and it is non-refundable.

-

Processing fee

A nominal processing fee starting from 2.5% of the loan amount is levied and gets automatically deducted from the loan amount before disbursal.

-

Prepayment charges

Borrowers can easily pre-pay loans at their own convenience and as many times as they want to at no additional costs.

-

Late payment Fee

Borrowers should ensure paying all EMI’s on time to avoid any late fee. If you fail to pay EMI on time, a late fee of 24% per annum will be charged on the EMI amount.

Know the Lender

Get instant personal loan online from registered lenders on 5paisa’s P2P lending platform

-

Verified lenders across country

You get a chance to reaching out to thousands of verified investors spread across India through our P2P platform.

-

Multiple lenders offering instant personal loan

Even lenders interest is secured as multiple lenders fund a borrower’s requirement.

-

Avail loan up to Rs 10 lakh

Borrowers can avail loan up to Rs 10 lakh from multiple lenders depending on their credibility for a loan tenure ranging from 6 months to 36 months.

Some interesting reads

Frequently Asked Questions

5paisa P2P Limited is India's premier peer to peer lending sites for investors which connects verified creditworthy borrowers and lenders. 5paisa P2P provides customized loan products and alternate investment option where the borrower gets a loan at a very competitive interest rate and lender earns above average market return on the investment.

5paisa P2P is RBI certified NBFC-P2P which offers personal loans at low interest rate to borrowers. We offer complete online process with paperless documentation and fast disbursement.

You can take personal loan in just four simple steps. They are as follows:

- Register online and create an account

- Upload required documents

- Accept loan agreement

- Loan gets disbursed in your bank account

The eligibility to become a borrower at 5paisa Loans is fairly simple and basic.

- Resident of India

- At least 21 years old

- Monthly income of at least 18,000

- Income proof

- PAN Card

- Valid Id and Address proof

- Valid Bank account

You can avail loan starting from Rs 30,000 to Rs 10,00,000 depending on your eligibility. Loan tenure starts from 6 months and can go up to 36 months.