Lend smart with 5paisa Loans

- Upto 24% returns

- Verified Borrowers

Why lend?

Lend personal loans online to verified and creditworthy borrowers, and earn high returns.

High Returns on

Investment

Earn better returns than most traditional investment options

Fixed monthly

Income

Create passive monthly income with regular repayments from borrowers

Diversified

Portfolio

Lending on 5paisa loans offers an alternate investment to help you diversify your portfolio

Eligibility Criteria

Facilitating convenient lending opportunities to everyone

-

Resident of

India -

At least 18

years old -

PAN card

-

Valid Id and Address proof

-

Valid Bank account

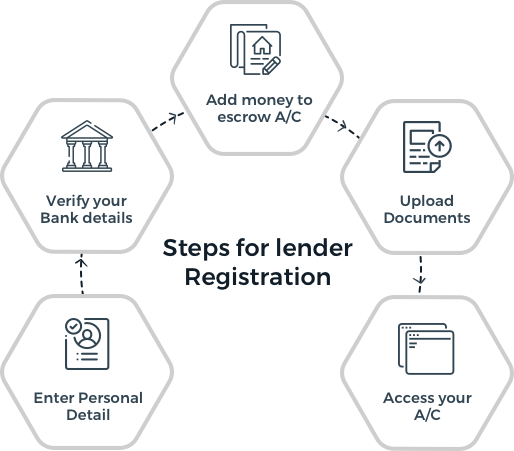

How to register as a lender?

Grow your money with India’s highly trusted peer to peer lending platform. Start lending personal loans in 5 minutes with a paperless process

Lending process

Lending money for online is simple and easy with 5paisa Loans

-

1. Register as Lender

To begin lending, you need to first create an ‘Investor Account’ by filling in a simple online form, along with uploading the required documents. The registration is completely free of cost.

-

2. Transfer funds to your escrow account

Transferring money to escrow account is easy and safe, it enables faster and secure transaction. You can start lending as low as Rs 500 with a maximum exposure of Rs 50,000 per borrower. Your aggregate exposure to all borrowers across all P2Ps, is subject to a cap of Rs 10,00,000.

-

3. Select borrower of your choice

Browse through the active list of borrowers, review the detailed profile and select the borrower of your choice to start lending. Approved loan amount, interest rate and tenure are mentioned along with a detailed profile of each borrower. All borrowers are listed after a stringent credit underwriting process.

-

4. Disbursal of funds

Once the loan agreement is accepted by the borrower, the loan application is processed within 24 hours. Once approved, the loan amount is deposited in the borrower’s bank account on the same day

-

5. Receive monthly installments

The EMI for repayments are directly credited to your bank account as per the schedule mentioned in the loan agreement. You can choose to re-invest them by adding it back to your escrow account

-

6. Loan closure

Once the principal and interest repayment is complete, the loan is closed and the transaction is completed for that borrower

Returns and Charges

Higher returns. Transparent and low fee structure.

Earn better returns than most traditional investment options.

-

Select borrower as per your risk appetite:

Independently decide how much return you want to. You can lend to borrowers starting at 12% to 36% as per your risk appetite and borrower’s creditworthiness. Your returns will be equal to the interest rate of the borrower.

-

Earn attractive returns

You can earn returns starting from 12% to 36% per annum

-

Independent interest rate agreements

Interest rate agreements are completely between lenders and borrowers across the platform.

-

Earn weighted average returns

Diversify your investment and earn weighted average of the individual loan parts

Make every rupee count with our cost-effective online personal loan lending solution

5paisa levies no charge for registering as an investor. Instead, all benefits derived from this low-cost effective model in the form of attractive returns and low transaction fees, are passed on to the investors. The only fee applicable is processing fee charged at 1.5% of the disbursed amount.

-

0

Registration fee

for investors -

1%*

Processing fee on

disbursed amount

Know your borrower

Build your portfolio by selecting borrowers that meet your criteria

You will be lending to individuals, both salaried and self-employed. Borrowers are listed on 5paisa only after a rigorous assessment with advanced technology.

Borrower’s creditworthiness is evaluated on following parameters and he/she is accordingly categorized in the respective risk category.

- CIBIL score

- Repayment history

- Cash flows

- Document verification

- Physical verification

- Ability to pay

- Intent to pay

Some interesting reads

Frequently Asked Questions

5paisa Loans is India's preferred lending platform that ensures premier service, transparent processes and healthy ROI for its lenders. It’s a platform that connects lenders, looking for higher returns and portfolio diversification, with verified creditworthy borrowers. 5paisa Loans provides customized loan products and alternate investment option where the borrower gets a loan at a very competitive interest rate and lender earns above average market return on the investment.

5paisa P2P is RBI certified NBFC-P2P which offers complete online and paperless process.

You get

- Verified borrower listing

- Creditworthy borrowers

- Fixed monthly returns

- Above average market returns

Start Lending in 4 simple steps

- Register Online and create account

- Upload required documents

- Add money in escrow

- Choose borrowers & start lending