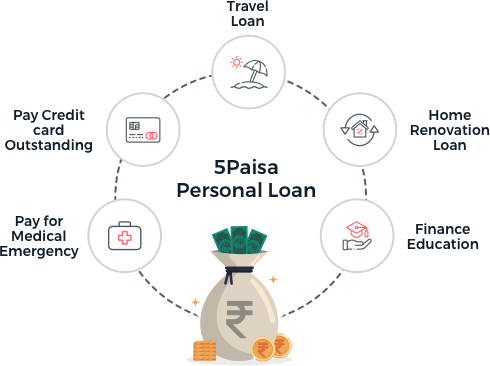

Personal Loan by 5paisa

Features of Personal Loan

5pasia Loans aims at making the entire personal loan process as lucid as possible. We offer collateral-free

personal loans, with instant system-based approval and quick disbursement. Our entire loan application

process is completely paperless. The interest rates are also extremely competitive.

-

2 Minutes

approval -

Loan disbursal

in 24 hours -

Interest rate

starting 10% p.a. -

Zero Foreclosure

charges -

Paperless

application

Personal Loan EMI Calculator

5paisa personal loan calculator helps you calculate your estimated EMIs with ease.

All you need to do is key-in the desired amount, tenure and interest rate.

- Principal

- Interest

Personal Loan Eligibility Criteria

Enabling affordable borrowing opportunities for everyone

No get personal loan for all your needs. If you fulfil simple criteria as listed below, you can apply fill in our paperless

application and get personal loan approval in 2 minutes

Rates & Charges for Personal Loan

Instant personal loans at competitive interest rates

Personal loans offered at affordable rates, pocket-friendly EMIs and no hidden fees. Borrowers can benefit from their

creditworthiness built over years.

Documents Required to Apply for Personal Loan

Getting personal loans with 5paisa Loans is fairly simple with 5paisa Loans. It’s hassle-free. The documentation process is paperless and you need minimum documents for instant approval.

How to apply for Personal Loan?

5paisa Loans offers personal loans approvals in 2 minutes and disbursal in 24 hours. It is a peer-to-peer lending platform and you can view lenders listed with 5paisa Loans and connect with your preferred lender.Personal loan application is quick and hassle-free. It’s just a 4-step process

-

1. Register online

By registering online, you can digitally connect with the lenders to borrow funds. All you need to do is key-in your basic details and get started.

-

2. Complete Verification

In order to get your identity and credibility verified, you will be required to submit the documents online. Once the verification process is complete, you will be listed on our borrowers list.

-

3. Accept loan agreement

Basis your credit profile, you can easily find lenders. Once you find the lender, just accept the loan agreement to receive the desired amount.

-

4. Receive Loan

After the verifications, the amount is disbursed you to your account in less than 24 hours

Why 5paisa loans?

Here's why 5paisa Loans is the right choice for personal loan

Getting loans has never been more easier.

-

Backed by IIFL

5paisa Loans is a venture by 5pasia and backed by IIFL, one of India’s leading brokerage firm.

-

Quick Disbursement

Owing to the strong network of lenders, personal loans onces listed are instantly approved. Loan is disbursed within 24 hours of approval.

-

Zero foreclosure and higher flexibility

There are no pre-closure charges applicable on your loan, so you can pre-close it anytime for no additional cost.

-

No Collateral Requirement

The entire process is completely digital so it is quick and hassel-free. All the loan documents are collected online and processed in real time.

-

Robust Credit Evaluation Model

Different parameters including open loans, repayment history, income in hand, amongst others are taken into consideration when determining the creditworthiness.

Frequently Asked Questions

5paisa P2P Limited is India's premier peer to peer lending sites for investors which connects verified creditworthy borrowers and lenders. 5paisa P2P provides customized loan products and alternate investment option where the borrower gets a loan at a very competitive interest rate and lender earns above average market return on the investment.

5paisa P2P is RBI certified NBFC-P2P which offers personal loans at low interest rate to borrowers. We offer complete online process with paperless documentation and fast disbursement.

You can take personal loan in just four simple steps. They are as follows:

- Register online and create an account

- Upload required documents

- Accept loan agreement

- Loan gets disbursed in your bank account

The eligibility to become a borrower at 5paisa Loans is fairly simple and basic.

- Resident of India

- At least 21 years old

- Monthly income of at least 18,000

- Income proof

- PAN Card

- Valid Id and Address proof

- Valid Bank account

You can avail loan starting from Rs 5,000 to Rs 10,00,000 depending on your eligibility. Loan tenure starts from 6 months and can go up to 36 months.